Important Update:

On February 27, 2025, FinCEN announced that companies won’t face fines or penalties if they miss the current deadlines for filing their beneficial ownership information (BOI) reports—March 21, 2025, for most businesses. FinCEN also plans to issue an interim final rule by March 21, 2025, to extend BOI reporting deadlines. Further, FinCEN intends to seek public input on potential changes to existing BOI reporting requirements.

What Is The Corporate Transparency Act?

The Corporate Transparency Act, or the CTA, enhances corporate transparency to combat money-laundering, terrorism, tax evasion, and other financial crimes. It does so by setting up a national database that identifies the humans behind the companies. This database helps law enforcement sift through companies used for nefarious purposes. The CTA requires privately held corporations, partnerships, limited liabilities companies, and other entities registered with a Secretary of State (or similar agency), to file a Beneficial Ownership Information Report (BOIR).

The Requirements of the Corporate Transparency Act

Under the CTA, business entities must disclose these specific company details to the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN):

- Company’s legal name

- Address of business

- Jurisdiction where business formed

- Tax identification number

The company must also provide details concerning its beneficial owners. These individuals hold at least 25 percent ownership interest over the company.

- Full legal name

- Date of birth

- Current address

- Unique identification number

How to Report

Reporting companies will have to report beneficial ownership information electronically through FinCEN’s website: www.fincen.gov/boi.

Important Note: A trust isn’t classified as a reporting company per the CTA. However, if your trust holds a stake in a reporting company (e.g., an LLC), you may need to disclose specific details about your trust under the CTA. Learn more about how the CTA could impact your estate plan here on our blog.

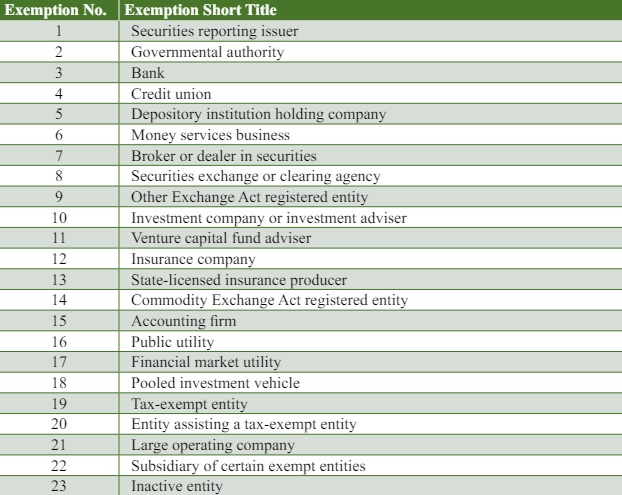

Exemptions

There are several exceptions to the Corporate Transparency Act, including:

- Large Operating Company: Entities employing more than 20 full-time employees.

- Subsidiaries: Any subsidiaries of a large operating company.

- Investment Companies: Companies primarily investing in stocks and securities, including basic investment partnerships.

- Charities: Organizations such as the Catholic Church.

- Inactive Companies: Companies that don’t conduct any business, have not sent or received more than $1,000 through a financial account, and were in existence on January 1, 2020.

Deadlines

Reports will be accepted starting on January 1, 2024.

If you registered your company before January 1, 2024, you have until January 1, 2025, to report beneficial ownership information (BOI). However, if you register your company between January 1, 2024, and January 1, 2025, BOI must be reported within 90 days. Finally, if you register a company after January 1, 2025, you must file BOI within 30 days of registration confirmation. Furthermore, any changes to previously submitted beneficial ownership information should be updated within 30 days.