The ULA Tax and What It Means for You

The ULA Tax April 1st, 2023, marks the day California’s housing bill, United to House L.A. (ULA), takes effect. The housing bill was created to fund more affordable housing to decrease homelessness in California. However, with…

March Local News Update

Tax Deadline Extension Please be advised: The tax deadline has been extended to October 16 for disaster area taxpayers in California to file various federal individual and business tax returns and make tax payments. Local…

The Fight Over Lisa Marie Presley’s Estate – What’s Happening and How Can You Avoid This

A Trust Dispute It made headlines when Lisa Marie Presley, daughter of the great Elvis Presley, suddenly passed away on January 12, 2023. However, shortly after that, the headlines quickly shifted to the dispute over…

Transparency During the Trust Administration Process

When a loved one passes away, the successor trustee distributes the assets according to the decedent’s last wish. During that time, emotions are high, and things can become contentious and potentially lead to a lawsuit…

Did You Know That a Trustee Has Tax Duties?

A trustee takes responsibility for managing money and assets set aside in a trust for the benefit of another person. Along with this financial responsibility comes tax duties. A trustee must file complete and accurate…

Deciphering the SALT Workaround

The state and local tax (SALT) deduction permits taxpayers who itemize when filing federal taxes to deduct certain taxes paid to state and local governments. However, the 2017 Tax Cuts and Jobs Act imposed a…

Litigation vs. Mediation vs. Arbitration – what is the best route for you?

By Matthew G. Stein, Esq. As a trial attorney, I often advise my clients that cases are won or lost on the opening statement – after that, you have very little control in a trial…

Trustee Duties When Trustor Is Incompetent

So, you’ve found yourself in the position of trustee and are managing your loved one’s estate while they are still alive. What are your duties to account to the eventual beneficiaries of your loved one’s…

Protecting Your Digital Legacy

How to Manage Your Photos, Data & Social Media Accounts After You Die Thinking about your “digital legacy” may seem strange but given the amount of data and content we all use and create (think…

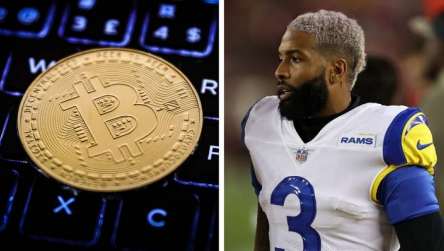

Careful With Your Crypto!

A few weeks ago, the Rams won a Super Bowl for the first time since they have called Los Angeles “Home”. One of their stars, Odell Beckham Jr. (“OBJ”), signed a one-year contract prior to…

New Year! New Attorneys! Same First-Rate Counsel!

As we enter a new year, we extend our appreciation and gratitude to both our existing and new clients. We have a genuine passion for what we do and we thank you for trusting Law…

‘Tis The Season…For Tax Exempt Gifting!

As the holidays are fast upon us, many are concerned with ensuring they have the perfect gifts for their loved ones. However, gifts are not only the wrapped goodies left under the tree or on…

Cryptocurrency & Estate Planning

Cryptocurrency or virtual currency (used interchangeably) has become quite the coveted asset among investors because of the seemingly lucrative return due to its fast appreciating nature. Cryptocurrency has also been the subject of growing interest…

New SALT Cap Workaround (AB 150) May Provide Tax Savings for You

California has enacted AB150, joining the growing list of states implementing a workaround on the current $10,000 cap on state and local tax deductions. A Little Background In 2017, as part of the Tax Cuts…